admin1

August 17, 2025

Exploring TPMS Valve Stems Innovations and Market Shifts in 2025

The tire pressure monitoring system (TPMS) sector is experiencing rapid growth as vehicles become more advanced and safety regulations become stricter. By 2025, the market for TPMS valve stems is expected to reach USD 8.76 billion, with the Asia-Pacific region leading the way due to automotive industry expansion and regulatory mandates. Direct TPMS continues to be the dominant technology, providing enhanced localization and seamless smartphone integration. Customers benefit from durable, corrosion-resistant tpms valve options that support predictive maintenance, while installers enjoy simplified repairs and access to digital service solutions. Manufacturers are adapting to regulatory changes by utilizing innovative materials and implementing digital supply chains. These evolving trends offer valuable insights for everyone involved, shaping product selection, installation techniques, and ensuring compatibility with next-generation vehicles through advanced tpms valve solutions.

Key Innovations in TPMS Valve Stems Design

Snap-In vs. Clamp-On TPMS Valve Stems

Automotive engineers continue to refine the design of tire pressure monitoring system stems. Two main types dominate the market: snap-in and clamp-on. Each offers unique advantages for both installers and vehicle owners.

- Rubber snap-in valve stems have become more popular as original equipment manufacturers move away from aluminum clamp-on stems. This shift results from corrosion issues that often affect clamp-on designs.

- Snap-in stems use rubber, which resists corrosion better than aluminum. This material choice helps prevent problems caused by salt, sand, humidity, and road grime.

- Installation of snap-in stems is straightforward. Technicians use a valve puller tool to fit the stem through the rim hole. This process eliminates the need for torque tools and nuts, which clamp-on stems require.

- Clamp-on stems rely on a rubber grommet that can harden and fuse in the valve hole. This can lead to slow air leaks, especially after tire deflation.

- Despite their corrosion resistance, rubber snap-in stems can dry out, harden, and crack due to environmental exposure, especially from UV rays. Regular replacement during tire servicing prevents leaks.

- Clamp-on aluminum stems, while durable, are vulnerable to corrosion. This can cause air leaks and damage during repairs, especially when the grommet hardens.

- Both types require regular replacement of service kits to maintain performance. Snap-in stems offer easier serviceability but may need more frequent replacement due to material degradation.

Tip: Regular inspection and timely replacement of both snap-in and clamp-on stems ensure optimal tire pressure monitoring system performance and safety.

Advanced Materials and Corrosion Resistance in TPMS Valve

The tire pressure monitoring system market has seen significant product innovation in materials. Manufacturers now use advanced alloys and composites to improve the durability and corrosion resistance of tpms valve stems.

The latest market reports highlight the adoption of metal-stem direct TPMS valves with enhanced corrosion resistance. These new materials extend the lifespan of stems and reduce the risk of leaks. Rubber snap-in valve stems provide a corrosion-resistant alternative with fewer parts and easier installation. However, rubber can degrade over time, so regular replacement remains important.

| Aspect | New Corrosion-Resistant Materials (Advanced Alloys, Composites) | Traditional Materials (Brass, Rubber) |

|---|---|---|

| Longevity & Durability | Enhanced durability; better corrosion resistance; withstands high pressure and harsh environments | Good corrosion resistance (brass); rubber less durable under harsh conditions |

| Cost | Higher initial cost due to raw material volatility and tariffs; mitigated by optimized production and supply chains | Lower upfront cost; more stable pricing historically |

| Technological Integration | Supports sensor modules and digital monitoring for predictive maintenance, reducing downtime | Limited integration capabilities |

| Environmental Impact | Focus on recyclability and reduced carbon footprint; aligns with sustainability goals | Less emphasis on sustainability; traditional materials may have higher environmental impact |

| Manufacturing Advances | Use of additive manufacturing and precision machining enables rapid prototyping and customization | Conventional manufacturing methods |

| Market Drivers | Increasing demand from electric and autonomous vehicles; regulatory and sustainability pressures | Established use in conventional vehicles |

This comparison shows that advanced materials in tpms valve stems offer longer life and better performance in harsh environments. Although the initial cost is higher, these stems support new sensor technology and align with sustainability goals.

Integrated Sensor Technologies in Tire Pressure Monitoring System

Modern tire pressure monitoring system stems now feature integrated sensor technology that transforms vehicle safety and maintenance. These sensors provide real-time monitoring, improved accuracy, and longer battery life.

| Integrated Sensor Technologies in TPMS Valve Stems | Benefits Over Previous Generations |

|---|---|

| Pressure sensors, analog-digital converters, microcontrollers, system controllers, oscillators, radio frequency transmitters, low frequency receivers, voltage regulators (battery management) | Improved sensor integration enabling accurate pressure monitoring and efficient battery use |

| Battery management with voltage regulators to prolong battery life | Avoids frequent tire dismounting for battery replacement, unlike first-generation sensors with non-exchangeable batteries |

| Valve stem corrosion addressed by nickel-coated valve cores | Reduces galvanic corrosion and valve stem seizure issues common in earlier metallic valve stems |

| Two-way communication capabilities (in some aftermarket units) | Enables sensor wake-up and remote monitoring, unlike first-generation one-way communication sensors |

| Advanced monitoring options including data logging and remote monitoring | Enhances user convenience and maintenance capabilities compared to limited first-generation features |

Manufacturers now use Bluetooth Low-Energy (BLE) technology in tire pressure monitoring system sensors. This allows two-way wireless communication, remote diagnostics, and over-the-air updates. Tire-mounted sensors provide direct monitoring of road conditions, tread wear, and tire load. Nickel-coated valve cores reduce corrosion, a common issue in earlier designs.

Capacitive sensors offer higher accuracy in tire pressure measurement. Integration with vehicle systems enables real-time adjustments and improved stability. Wireless connectivity allows remote monitoring through vehicle computers or mobile apps. Predictive analytics help anticipate tire pressure issues before they occur. Self-adjusting systems optimize tire pressure based on driving conditions.

Major automotive manufacturers have adopted these integrated sensor technologies at a rapid pace. Regulatory mandates and the rise of advanced driver-assistance systems (ADAS) drive this trend. The fully integrated TPMS sensor segment now holds the largest market share. Regional adoption is especially strong in North America and Asia-Pacific, where original equipment manufacturers include integrated tire pressure monitoring system sensors as standard equipment.

Note: Integrated sensor technology in tire pressure monitoring system stems delivers improved safety, convenience, and proactive maintenance, setting a new standard for vehicle monitoring.

Market Drivers and TPMS Trends for 2025

Regulatory Changes Impacting TPMS Valve Stems

Regulatory changes shape the tire pressure monitoring system market in 2025. New U.S. tariffs on aluminum, brass, and specialty rubber increase costs for TPMS valve stems. Manufacturers respond by shifting sourcing strategies and investing in domestic production. These changes drive innovation in product design, focusing on cost containment and value engineering. Stricter mandates like FMVSS 138 in North America and UNECE R64 in Europe require advanced performance testing. Manufacturers develop modular, versatile tire pressure monitoring system designs to meet these standards. They use hybrid composites and advanced elastomers to ensure durability and compliance. Companies also invest in vertical integration and strategic partnerships to create sensor-embedded valve solutions. Supply chain resilience becomes a priority, with regional manufacturing centers reducing risks. These trends push the tire pressure monitoring system market toward lightweight, fail-safe, and connected valve stems.

Electric Vehicle Growth and TPMS Market Shifts

The rise of electric vehicles transforms the tire pressure monitoring system market. EVs need lightweight, high-strength, and temperature-resistant materials for valve stems. North American manufacturers invest in research and development for smart valve systems. These systems integrate pressure sensors and AI diagnostics. The growing demand for electric vehicles drives the need for advanced tire pressure monitoring system solutions. The market for automotive valves, including tire valves, is projected to reach $32.89 billion in 2025. Modular valve solutions improve battery cooling and vehicle safety. The expansion of electric vehicles increases the importance of reliable tire pressure monitoring system components. The market is expected to grow rapidly, with connected TPMS and AI integration becoming standard. Luxury electric vehicles, such as Tesla, use clamp-on metal stems and programmable sensors to meet specific needs.

Consumer Demand for Safety and Convenience in TPMS

Consumer demand for safety and convenience continues to influence the tire pressure monitoring system market. Drivers expect real-time monitoring and accurate alerts to prevent tire failures. The growing demand for advanced features leads to the adoption of integrated sensors and user-friendly designs. The tire pressure monitoring system market responds with solutions that offer predictive maintenance and seamless connectivity. Luxury electric vehicles set new standards for safety and convenience, pushing manufacturers to innovate. These trends provide valuable insights for companies aiming to meet the needs of modern vehicles and safety-conscious consumers.

Installation and Compatibility Trends in TPMS Valve Stems

Universal Adapters and Cross-Platform TPMS Solutions

Universal adapters and cross-platform solutions have become essential in the tire pressure monitoring system market. Companies like Autel now offer diagnostic tools and universal adapters that support a wide range of vehicles, from commercial trucks to electric cars like Tesla. These tools, such as the MaxiSYS Ultra S2 Diagnostics Tablet, allow technicians to program TPMS sensors quickly and perform relearn procedures with ease. This approach improves valve stem compatibility and reduces the need for multiple sensor types in inventory.

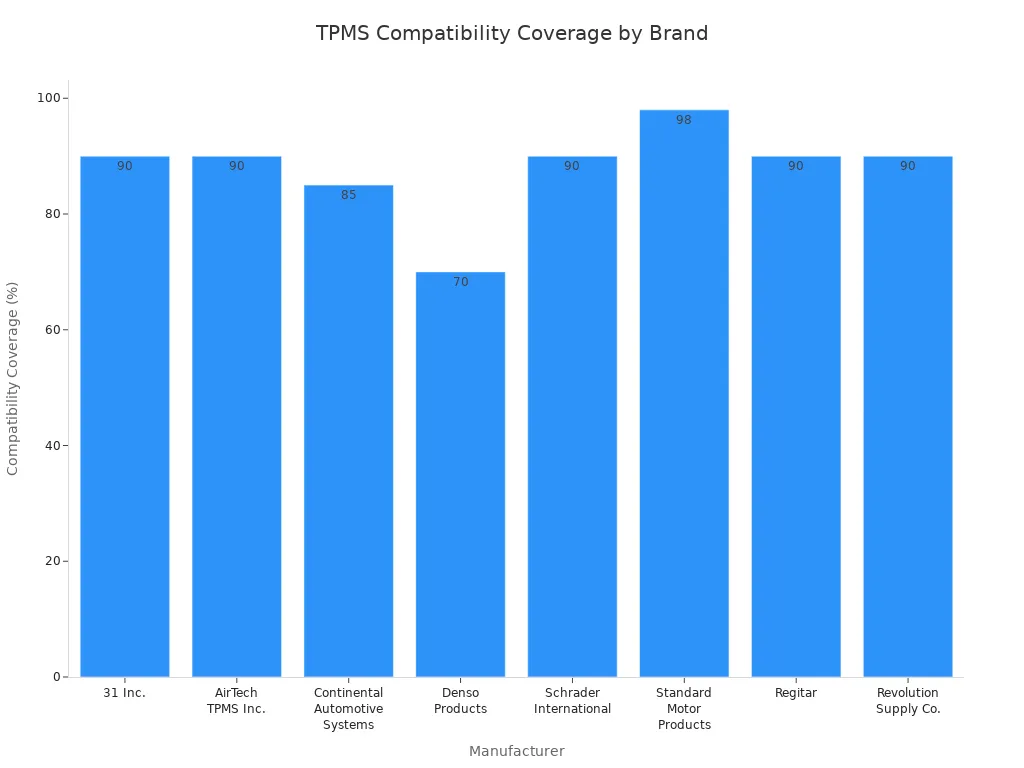

Manufacturers have developed programmable sensors that cover up to 98% of vehicles, including domestic, European, and Asian models. For example, Schrader’s EZ-sensor uses tri-band technology to support evolving OE technologies, while Continental’s VDO REDI-Sensor works with all major TPMS scan tools. These innovations simplify installation and ensure that tire pressure monitoring system stems fit a broad range of vehicles.

User-Friendly Features for TPMS Installation

Recent trends in the tire pressure monitoring system sector focus on making installation easier and more reliable. Many programmable sensors now require only a few seconds to set up, reducing service time. Pre-programmed sensors eliminate the need for additional steps, allowing for direct installation. Companies design stems with adjustable angles and snap-in features, which help technicians achieve a secure fit without special tools.

Technicians benefit from clear instructions and support resources, which minimize installation errors. Some brands provide 24/7 technical support and training, ensuring that even less experienced installers can achieve proper valve stem compatibility. These user-friendly features improve safety by reducing the risk of leaks or sensor failures.

Enhanced Compatibility with Aftermarket and OEM Tire Pressure Monitoring Systems

Manufacturers have prioritized compatibility between tire pressure monitoring system stems and both aftermarket and OEM systems. Dual-frequency programmable sensors (315/433 MHz) now support multi-brand and multi-region vehicles. Bluetooth-enabled sensors offer real-time monitoring and longer battery life, often lasting up to ten years. Compliance with standards like ISO/TS 16949 and regional regulations ensures consistent quality and safety.

Companies use advanced rubber compounds, such as EPDM, to extend the life of stems and improve sealing. Precise manufacturing tolerances guarantee a proper fit with various sensor electronics and wheel designs. Modular sensor designs allow rapid customization for different vehicle classes, supporting both OEM and aftermarket needs. Strategic collaborations and local manufacturing further enhance supply chain resilience and product quality. These trends ensure that tire pressure monitoring system stems deliver reliable performance and safety across all vehicle types.

Future Innovations in TPMS Valve Stems

Wireless and Battery-Less TPMS Sensor Developments

Wireless and battery-less sensor technologies are shaping the future of the valve stem in the tire pressure monitoring system market. These sensors use energy harvesting methods such as piezoelectric, thermoelectric, and RF energy harvesting. They eliminate the need for batteries, making sensors maintenance-free and eco-friendly.

- Wireless Solar TPMS sensors are gaining popularity. Users praise their easy installation and reliable performance. However, some report setup complexity and valve stem compatibility issues.

- Plug-and-play sensors and universal valve stem adapters are recommended to improve user experience.

- Automatic sensor pairing features are under development to address manual pairing challenges.

- Battery-less sensors integrate with IoT and advanced wireless protocols like Bluetooth Low Energy and LPWAN.

- Regulatory mandates in the U.S., EU, and China drive market growth, especially in electric vehicles.

- North America leads TPMS sales, while Asia-Pacific is the fastest-growing region.

- Battery-less sensors reduce maintenance costs by 20–30% and support sustainability goals.

- The market is projected to grow at a CAGR between 7.2% and 12.91%.

- Key industry players include Continental AG, Huf Hülsbeck & Fürst GmbH & Co. KG, and Sensata Technologies Inc.

Battery-less TPMS sensors provide higher accuracy and reliability compared to traditional models. They offer longer lifespan, easier installation, and better integration with advanced vehicle systems. Although the initial cost is higher, total ownership costs decrease over time due to reduced maintenance and replacement needs. These sensors support lightweight and efficient designs, which benefit electric and autonomous vehicles.

AI Integration and Predictive Maintenance in Tire Pressure Monitoring System

AI integration is transforming tire pressure monitoring system sensors. AI analyzes pressure and temperature data from sensors to predict tire wear, detect early leaks, and assess failure risks before problems arise. Predictive maintenance enables proactive monitoring and instant alerts, preventing blowouts and optimizing tire pressure.

| Sector | AI Integration & Predictive Maintenance Features | Real-World Results & ROI |

|---|---|---|

| Mining | AI predicts wear patterns, assesses failure risks, and suggests operational optimizations. | 30% reduction in tire-related downtime, 22% longer tire life, 45% fewer safety incidents, zero tire-related accidents for 18 months, investment paid off in 9 months |

| Construction | Direct TPMS with AI-driven analytics for precise inflation and early leak detection. | 15% fuel savings, 23% reduction in tire replacement costs, improved equipment uptime, ROI achieved in under a year |

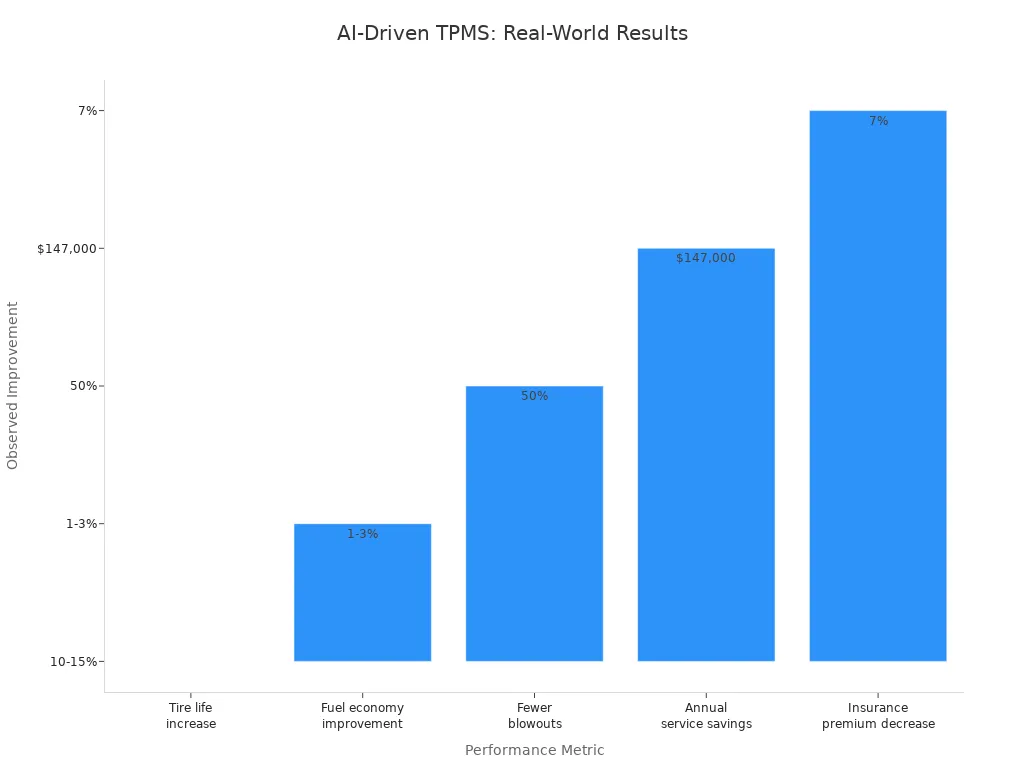

| Long-Haul Trucking | Continuous real-time monitoring with AI alerts for optimal pressure and safety. | 50% fewer blowouts in first year, $147,000 annual emergency service cost reduction, 7% insurance premium decrease, more on-time deliveries |

| Technical Features | Direct TPMS sensors with ±1-2 PSI accuracy, early leak detection, temperature measurement. | Integration with telematics, customizable dashboards, automated maintenance scheduling, and load optimization. |

| Implementation Notes | Retrofitting possible, sensor calibration and placement critical, professional installation recommended. | Training for alert interpretation and maintenance workflows essential for workforce adoption. |

AI-enabled tire pressure monitoring system sensors deliver measurable benefits. These include longer tire life, improved fuel economy, fewer blowouts, and reduced emergency service costs. Real-world results show a 10–15% increase in tire life and a 50% reduction in blowouts for long-haul trucking.

Smart Vehicle Ecosystem and TPMS Valve Stems

TPMS valve stems now integrate with smart vehicle ecosystems, connecting with advanced driver-assistance systems and telematics. This integration enables real-time monitoring and wireless connectivity. Sensors share tire condition data with vehicle systems and external platforms, supporting remote diagnostics and predictive maintenance.

Battery-less and energy harvesting sensor technologies extend sensor lifespan and reduce maintenance. Integration with smartphone apps and infotainment systems provides immediate alerts and analytics, improving driver awareness and vehicle performance. Vehicle owners benefit from enhanced safety, improved fuel efficiency, reduced downtime, and convenience from remote monitoring and over-the-air updates.

TPMS supports autonomous driving and traffic safety through V2X communication. Advances in sensor miniaturization and wireless protocols improve device compactness and energy efficiency. These future trends position tire pressure monitoring system valve stems as critical components in smart vehicles, enhancing safety and performance for all types of vehicles.

Regional and Market Segment Trends in TPMS

OEM vs. Aftermarket TPMS Valve Stems Dynamics

The tire pressure monitoring system market in 2025 shows clear differences between OEM and aftermarket TPMS valve stems. OEM stems follow strict specifications and work closely with vehicle manufacturers. These stems integrate with original equipment and meet high engineering standards. Aftermarket stems focus on adaptability and cost-effectiveness. They fit many tire profiles and offer easy installation for consumers and service shops.

| Aspect | OEM TPMS Valve Stems | Aftermarket TPMS Valve Stems |

|---|---|---|

| Application | Stringent specifications; collaborative development with vehicle manufacturers; integration with original equipment engineering and production standards | Adaptability to various tire profiles; ease of installation; cost-effectiveness |

| Distribution Channels | Direct OEM relationships enabling long-term collaboration and tailored solutions | Bundled service packages; online retail platforms with extensive inventories and digital compatibility checks |

| Pricing Strategies | Recalibrating vehicle-level pricing due to rising component costs and tariffs | Offering bundled service packages to maintain customer loyalty |

| End-User Priorities | Vehicle manufacturers focusing on integration and quality standards | Individual consumers value affordability, reliability, advanced features (e.g., integrated pressure sensors, self-sealing); fleet operators emphasize total cost of ownership and durability |

| Supply Chain Dynamics | Leveraging global manufacturing networks | Adapting to tariff impacts through nearshore manufacturing and digital tracking tools |

| Technological Trends | Precision manufacturing (automated machining, injection molding) optimizing consistency and cost-effectiveness | User-friendly valve repairs and replacements via e-commerce; focus on durability and proactive maintenance |

OEMs use global networks to ensure consistent quality and supply. Aftermarket suppliers respond to tariffs by shifting to nearshore manufacturing and digital inventory tracking. Both segments contribute to the overall trends in the tire pressure monitoring system market.

Regional Growth Hotspots in TPMS Valve Stems Market

Several regions drive the growth of the tire pressure monitoring system market. The Asia-Pacific region leads, with China, India, and Southeast Asia showing rapid expansion. This growth comes from increased automotive production, evolving consumer expectations, and new TPMS mandates in China and India. Domestic suppliers in these countries innovate with cost-effective sensor platforms.

- Australia experiences growth due to rising vehicle ownership and electric vehicle adoption.

- Regulatory mandates in Australia and Asia-Pacific emphasize tire safety, increasing demand for advanced TPMS valve stems.

- Advancements in smart valve cap technology and digital transformation in automotive maintenance support market expansion.

- The U.S. market responds to tariff policies by investing in domestic manufacturing and optimizing supply chains.

- Southeast Asia’s aftermarket segment grows as vehicle owners seek enhanced safety features.

These regional market insights highlight the importance of regulatory frameworks, technology adoption, and consumer preferences in shaping the tire pressure monitoring system market forecast.

Segment-Specific Demands and Customization in TPMS Valve Stems

Segment-specific demands shape the customization of TPMS valve stems across the tire pressure monitoring system market. Commercial vehicles, passenger cars, and two-wheelers each require unique design specifications. Heavy commercial vehicles need durable stems with longer service intervals. Passenger cars often demand advanced data integration and compatibility with telematics platforms.

Manufacturers tailor TPMS valve stems to meet regional regulatory standards and frequency requirements, such as 315MHz or 433MHz. Sensor design and data handling also vary by vehicle segment and region. Leading companies use modular sensor designs and collaborate with OEMs to optimize stems for specific classes and standards. This approach improves production efficiency and aftersales support, meeting the diverse needs of the global tpms sensor market.

Note: Customization in the tire pressure monitoring system market addresses materials, sensor technology, and integration, ensuring each vehicle category receives optimal performance and compliance.

TPMS valve stems in 2025 reflect rapid advances in monitoring, materials, and integration. Direct and hybrid models now offer real-time monitoring and improved data accuracy. Regulatory changes across regions drive manufacturers to reassess compliance and invest in modular, durable designs. Buyers and installers benefit from clear steps: always replace seals and nuts on clamp-on stems, use correct torque, and select approved lubricants for snap-in stems. Manufacturers gain a competitive edge by investing in AI-driven monitoring, collaborating with telematics providers, and developing retrofit kits with mobile integration. These insights help all stakeholders adapt to evolving monitoring technologies and market demands, ensuring safety and efficiency. Strategic partnerships and regional customization further enhance product development, offering valuable insights for future purchasing and installation decisions.

FAQ

What are the main benefits of advanced materials in TPMS valve stems?

Advanced materials, such as high-grade alloys and composites, increase corrosion resistance and durability. These materials help valve stems last longer, even in harsh environments. Manufacturers use these innovations to meet strict safety standards and reduce long-term maintenance costs.

How do universal TPMS adapters improve installation?

Universal adapters allow technicians to fit TPMS sensors on many vehicle models. This reduces inventory needs and speeds up service. Tools like the MaxiSYS Ultra S2 Diagnostics Tablet support quick programming and relearn procedures, making installation more efficient for shops and fleets.

Why do electric vehicles require specialized TPMS valve stems?

Electric vehicles often use lightweight, high-strength valve stems to handle unique temperature and pressure demands. These stems support advanced sensor integration and help maintain battery efficiency. As EV adoption grows, manufacturers focus on developing TPMS solutions tailored for electric platforms.

What role does AI play in modern TPMS systems?

AI analyzes tire pressure and temperature data to predict wear and detect leaks early. This technology helps prevent blowouts and extends tire life. Real-world data shows fleets using AI-enabled TPMS experience up to 50% fewer blowouts and lower emergency service costs.